Fixed Rate on Housing Loans: Is it a good solution?

At a time when there has been talk of both Interest Rates and Inflation, leaving on alert the Portuguese who have Housing Credit with Variable Rate due to the rise in interest, the question arises whether this is the best time to change to a Fixed Rate.

The Fixed Rate is defined at the beginning of the contract by the Credit Institutions and remains unchanged for the period that is agreed between the customer and the Bank.

Thus, with this type of fee, the customer always knows what to count on in relation to the service, as it remains unchanged. This also means that if market interest rates, for example Euribor, rise or fall, the provision of a fixed-rate loan does not change.

And is the Fixed Rate the best option for me?

The advantage of this type of Rate is the stability and security it provides, since it allows you to have a payment always equal throughout the loan or over the term you set for the fixed rate, not being dependent on market fluctuations. With this modality there are no unforeseen events.

However, the customer pays a higher price for this security, since the fixed rate has higher values than the Euribor rates, being defined by each Bank.

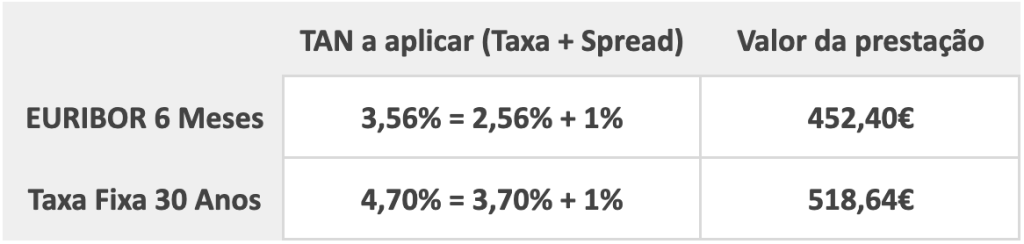

Take as an example a Housing Loan of € 100,000, with a term of 30 years, with a spread of 1%.

Let's compare the value of the installment between a variable rate with Euribor at 12 months and a fixed rate at 30 years (the latter currently practiced by one of the Banks that is our partner).

Historically, the period of high interest rates in the Eurozone has been short, which means that in recent years it has compensated more to have a Housing Credit with variable rate instead of fixed rate.

Still, many people end up preferring the flat rate for security reasons, because they know for sure how much their monthly charges are, without having any surprises.

It should be a well-considered decision, because in the case of descents, the benefit does not go down.

In Housing Loans with fixed rate the early amortizations are also subject to a commission of 2%, that is, whenever you amortize all or part of your Housing Credit agreement, you always pay 2% more on the amount you are amortizing at the time. (Variable rate contracts pay a commission of 0.5%).

There is no best of both worlds, and in this matter of choosing the rate that you will have associated with your credit agreement, you should always take into account the economic situation and your profile as a consumer.

Basically, it's just checking if you want to have some stability and pay for it, or if you don't worry about risk and future market swings.

In any of the situations, we always have a specialized and dedicated team to accompany you in this process, always ready to present you with the best option for your case.

Author: Marina Guedes, post made in partnership with credivel.pt, partner in credit mediation.